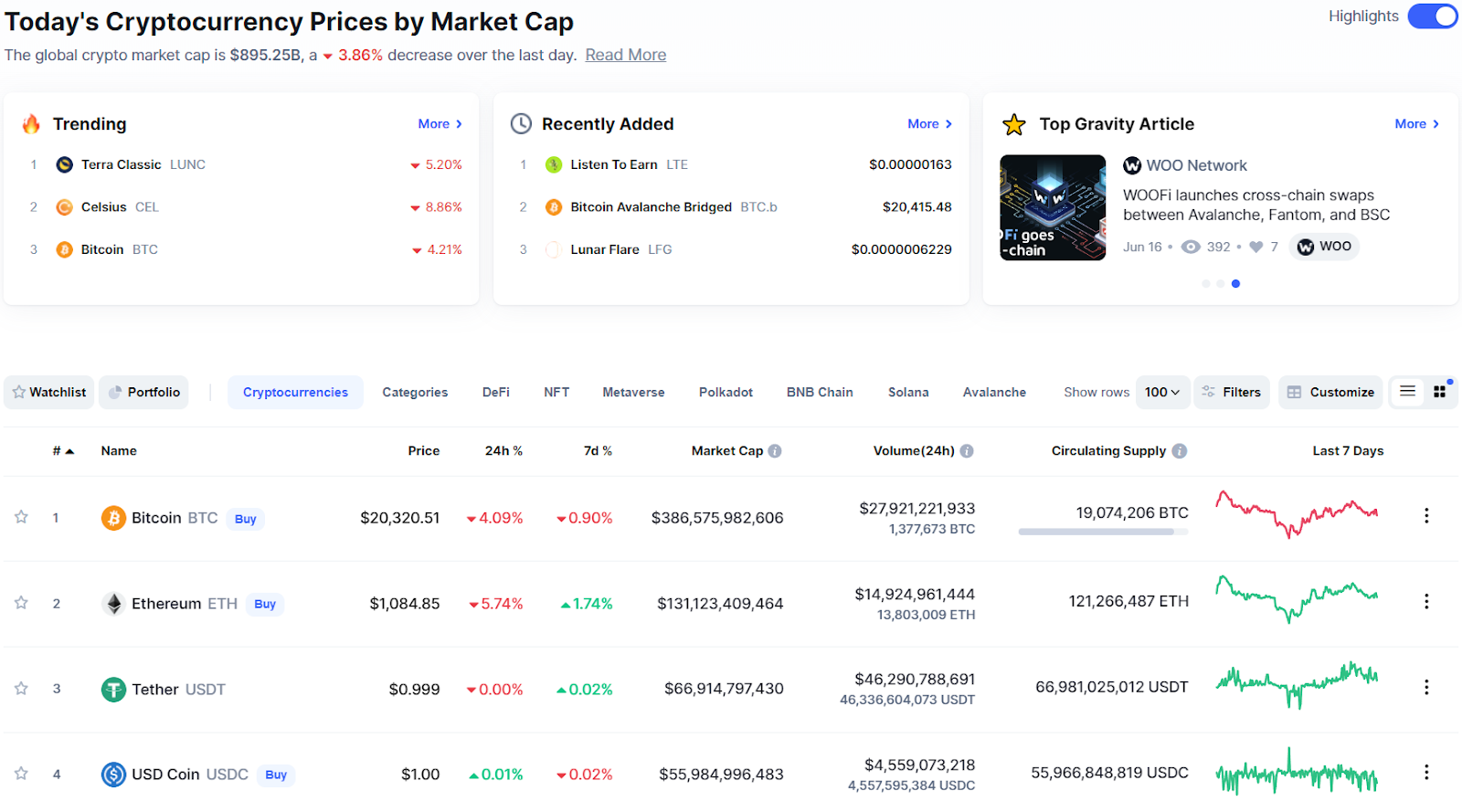

Market cap of all cryptocurrencies

Bitcoin is the pioneer of cryptocurrencies and the most commonly accepted coin at online crypto casinos. Its widespread use, brand recognition, and high market value make it a staple in the crypto gambling space https://intececologico.com/casino-review/shazam/.

Statistics don’t lie – most people prefer to play casino games on their phones rather than on desktops. This likely goes double for crypto enthusiasts, whose rigs are often hooked up to mine their crypto. Luckily, you can enjoy practically all crypto casinos on your phone, including all games, features, bonuses and promotions!

Crypto casinos with the proper accreditation and certification are legal in the UK. In the case of UK players, you’ll be looking for a licence from the United Kingdom Gambling Commission. A crypto casino site without a licence may not be a legal setup and isn’t worth your time.

What is the market cap of all cryptocurrencies

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

In order to send and receive a cryptocurrency, you need a cryptocurrency wallet. A cryptocurrency wallet is software that manages private and public keys. In the case of Bitcoin, as long as you control the private key necessary to transact with your BTC, you can send your BTC to anyone in the world for any reason.

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

In order to send and receive a cryptocurrency, you need a cryptocurrency wallet. A cryptocurrency wallet is software that manages private and public keys. In the case of Bitcoin, as long as you control the private key necessary to transact with your BTC, you can send your BTC to anyone in the world for any reason.

Why do all cryptocurrencies rise and fall together

Bitcoin halving events are a perfect example of how supply and demand interact to influence prices. During a halving, the reward for mining bitcoin is cut in half, reducing the rate at which new coins are created. This reduction in supply often leads to significant price movements.

In conclusion, the fluctuations in cryptocurrency prices are influenced by various factors, including market sentiment, supply and demand dynamics, technological advancements, market manipulation, and regulatory conditions. Gaining a deeper understanding of these factors empowers you to navigate the crypto landscape more confidently. With this knowledge, you can make informed decisions and confidently engage in crypto trading using the Busha app.

Interestingly, not all investors experience the same outcomes. A recent study revealed that 57% of cryptocurrency investors made money in the past year, while 16% broke even, and 14% reported losses. These statistics highlight how demand and trading activity directly influence price dynamics in the cryptocurrency market.