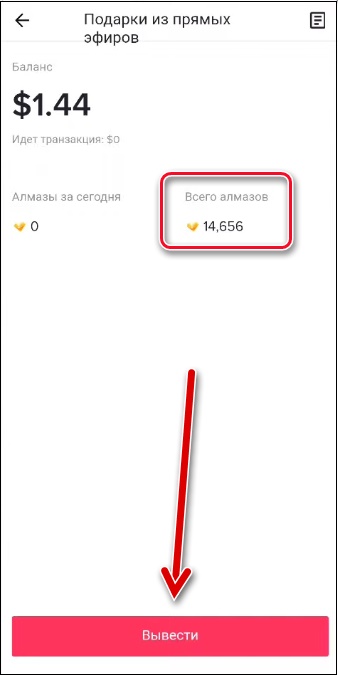

Одна из ключевых причин, по которой игроки выбирают Космолот, – это молниеносные выплаты. Скоростные транзакции уже стали стандартом для рынка. Космолот не выводит деньги вручную – все процессы автоматизированы для скорости. В то время как другие казино могут задерживать вывод средств на не определённый срок. Такой технический прогресс стал возможен благодаря усилиям многих специалистов, и большим инвестициям в индустрию.

Легальность и прозрачность выплат

Прежде всего, Космолот – это лицензированное онлайн-казино, которое работает в соответствии с украинским законодательством. Это значит, что деятельность контролируется государственными органами, а выплаты игрокам регулируются официальными стандартами. Легальное казино не может позволить себе мошенничество, так как это приведет к потере лицензии и судебным разбирательствам.

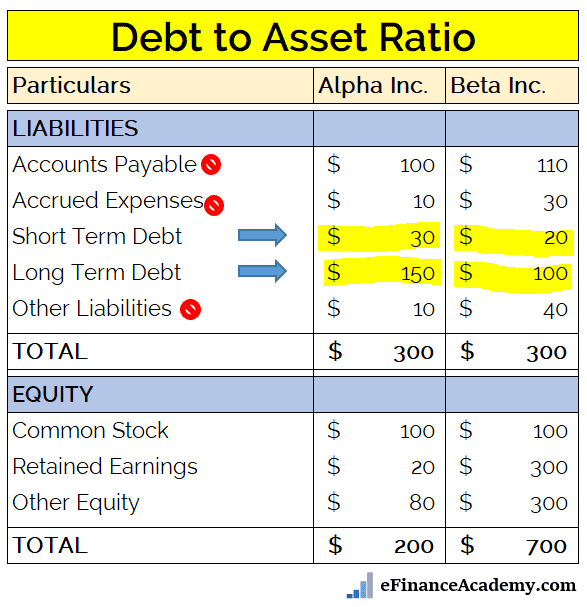

Ключевые финансовые преимущества площадки

Космолот не выводит деньги сложными способами, предлагая только удобные платежные методы. Тек же стоит отметить и другие инновации внедрённые брендом.

- Современные платежные системы. Казино сотрудничает с ведущими финансовыми сервисами, что позволяет проводить мгновенные транзакции.

- Автоматизированная система обработки заявок. Благодаря технологии быстрых выплат, деньги зачисляются без задержек

- Быстрые проверки клиентов. Аккаунт проходит верификацию максимально быстро, после чего средства выводятся буквально за несколько минут.

Рекомендации для быстрых выплат

Космолот не выводит деньги без проверки, обеспечивая безопасность транзакций. Для ускорения всех процессов, следуйте рекомендациям.

- Пройдите верификацию до активной игры. Дабы не отвлекаться на этот процесс в дальнейшем, сделайте это сразу после регистрации.

- Внимательно изучите условия бонусов. Перед тем как активировать акцию, убедиться, что сможете выполнить требования.

- Указывайте корректные реквизиты. Перед отправкой заявки на выплату проверять введенные данные.

- Играйте честно. Не создавайте несколько аккаунтов, и не используйте запрещенные схемы.

Соблюдая эти простые правила, у вас никогда не будет проблем с казино. Лицензированые платформы не могут допускать невыплат, так как это приведет к потере доверия пользователей и блокировке со стороны регуляторов.