In the hectic and ever-evolving globe of on-line gaming, totally free slots have ended up being a prominent choice amongst players seeking home entertainment and adventure. Whether you’re an experienced gambler or new to the world of on the internet gambling enterprises, complimentary ports use a fun and risk-free method to appreciate your preferred Continue reading

Signup for our Newsletter!

Author Archives: Vape Plus

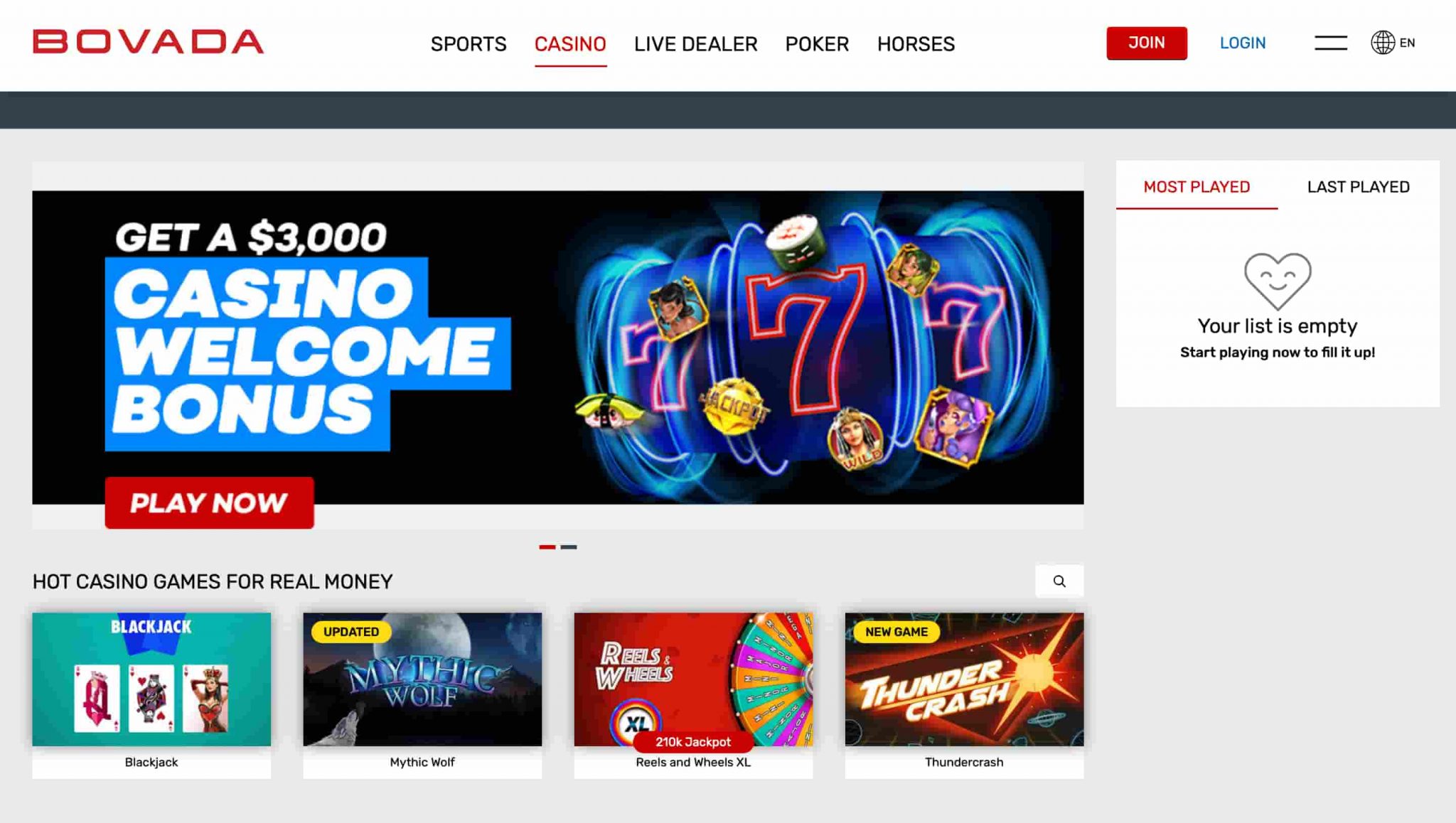

How to Win Real Money Online with no cost Casinos

Free online blackjack games can be a great method to spend some time. The question that is often asked is “Can I make money Gran Casino Aranjuez online when I play on the internet?” The answer is “yes”. If you are just beginning to play playing online casinos, you might not be familiar with the way the Continue reading →

The Surge of Actual Money Payout Games: An Overview to Exciting Opportunities

With the ever-growing popularity of online pc gaming, the realm of real money payment video games has actually mesmerized gamers worldwide. Gone are the days when gaming was merely a pastime; now, it provides an opportunity to win real cash and raise the pc gaming experience to brand-new elevations. In this write-up, we delve into the world of genuine Continue reading →

Mastercard Online Gambling Establishments: The Ultimate Guide to Secure and Convenient Betting

Mastercard, among the world’s most identified settlement solutions, has changed the way we make online purchases. With its smooth and secure payment process, Mastercard supplies a suitable option for gamers wanting to enjoy their favored gambling establishment video games at on-line casino sites. In this thorough guide, we will look into the globe Continue reading →

Casino Site Immediate Play: The Ultimate Guide

Picture having the thrill of playing your preferred casino site games without the hassle of downloading any type of software program or applications. With gambling establishment split second play, you can appreciate all the excitement of a brick-and-mortar gambling enterprise right from the convenience of your very own home. In this comprehensive Continue reading →

Play free casino games and earn cash

Are you in search of free casino games? If you are aware of where to look it’s easy to find them. It may seem that the free slot machines are available only in certain online casinos. However this isn’t the case. In fact there are a variety of places where you can play for free at casinos.

Progressive Netent is a U. S.situated Internet Continue reading →

The Increase of Mobile Gambling Enterprises: A Guide to Betting on the move

In recent times, the globe of on the internet gambling has experienced a significant vulkan vegas casino shift with the development of mobile casinos. Many thanks to developments in innovation, gamblers can currently appreciate their favored gambling enterprise video games anytime and anywhere, as long Continue reading →

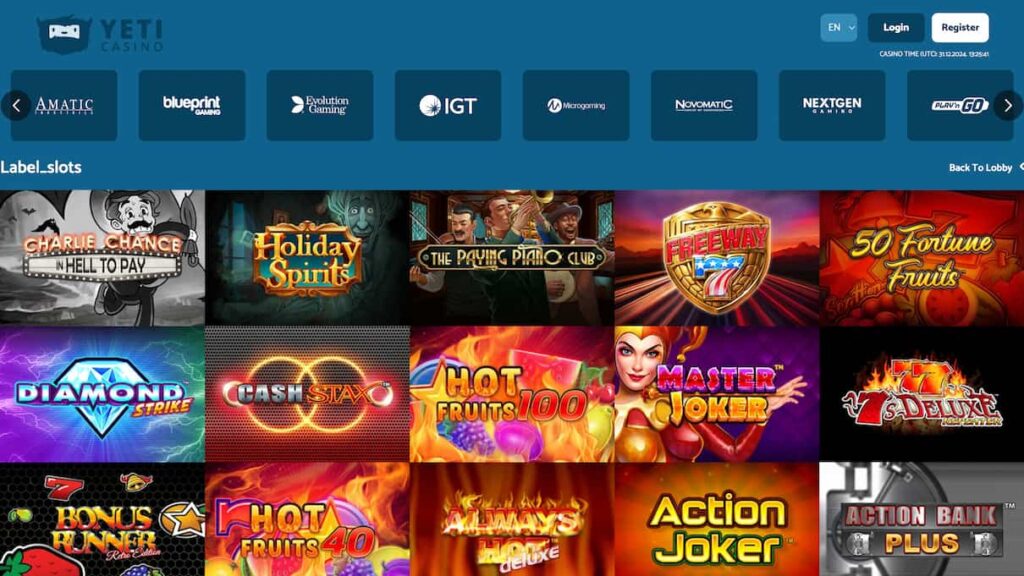

best online casino games

Best online casino games

An E-wallet is a prepaid account that is used to store money and make online payments. E-wallets are more secure than traditional payment methods because they use encryption technology https://amazingmicrowater.com/. No actual payment information is needed to make a secure transaction at an online casino. Another perk is that E-wallets are accessible through smartphones, making them a perfect option for gaming on the go.

Licensing plays a fundamental role in choosing safe online casinos in the USA. To operate legally in a state, online gambling legislation states that an operator must hold a valid license issued by the state’s regulatory authority, each of which has a website you can visit for more information. Numerous licensing authorities regulate gambling in individual states, and you’ll find them listed below.

Here, I will keep you on your toes by looking out for things like licensing and regulation, security protocols, fair games, and overall reputation. I’ll also list some of the best and worst online casinos for safety.

All the operators we feature in this review are the safest online casinos. Rest assured, we only recommend casinos that are legal and legitimate. Before making recommendations, we consider a safe gaming experience, secure deposits and withdrawals, and ultimate protection of personal data.

New online casino november 2025

The app sparkles with ingenuity, making smart use of limited real estate, with games sorted into useful categories. Sports betting and the casino are housed under one roof, and player wallets are shared between the two verticals.

One of the best reasons to give new online casinos a try is the fact that they often feature the newest, most exciting real money slots releases. Since these new sites need to stand out, they tend to have the latest and most popular games, making them some of the best casinos for playing unique and innovative games.

Prepaid cards and vouchers such as Paysafecard remain relevant for players prioritizing anonymity. These options are ideal for those who prefer to limit their spending or avoid linking bank accounts to gaming platforms.

The app sparkles with ingenuity, making smart use of limited real estate, with games sorted into useful categories. Sports betting and the casino are housed under one roof, and player wallets are shared between the two verticals.

One of the best reasons to give new online casinos a try is the fact that they often feature the newest, most exciting real money slots releases. Since these new sites need to stand out, they tend to have the latest and most popular games, making them some of the best casinos for playing unique and innovative games.

Online money glitch 2025 casino

Money glitches have always been a part of GTA Online, and many players continue to use them in 2025. While Rockstar Games is strictly against using exploits, players always find various workarounds to make extra money from select missions and jobs. Most of these glitches can earn you millions within a few minutes. However, there are always risks associated with them.

Much like questions over GTA 6’s potential PC release and whether the game will be delayed, the future of GTA Online is all anyone’s asking about right now. In the meantime, GTA Online is set to keep rolling out its updates and rinsing us for every penny.

Gfinityesports.com started as a community platform for competitive gamers to engage, play & compete with like-minded people. The site moved into producing content for these communities in 2019. All our editors & writers are passionate gamers with 1000’s of hours of play time in their favourite titles. All content is written & edited by staff who have played & researched the games.

This makes you good money while playing solo, but Cayo Perico Heist gives you more per hour due to how quick its prep work is. So you choose wether you want more money but do work or do almost No work and earn about the same or even more than the heist if lucky(tho likely you would earn about 1m an hour).

do all cryptocurrencies use blockchain

Do all cryptocurrencies use blockchain

Coinlore Independent Cryptocurrency Research Platform: We offer a wide range of metrics including live prices, market cap, trading volumes, historical prices, yearly price history, charts, exchange information, buying guides, crypto wallets, ICO data, converter, news, and price predictions for both short and long-term periods https://ippwatch.info/w/. Coinlore aggregates data from multiple sources to ensure comprehensive coverage of all relevant information and events. Additionally, we provide APIs and widgets for developers and enterprise users.

Cryptocurrency market capitalization (market cap) refers to the total value of a particular cryptocurrency that is currently in circulation. It is calculated by multiplying the current market price of a cryptocurrency by the total number of coins or tokens that have been issued. The total market capitalization of all cryptocurrencies for today is $3,482,102,116,442

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

Why do all cryptocurrencies rise and fall together

Emerging markets, where inflation and currency devaluation are common, have embraced Bitcoin as a financial safeguard. This trend reinforces its position as a viable alternative to traditional assets during economic uncertainty.

In other words, if you’re asking yourself, “Why is crypto going up,” it is because an increasing number of people have a positive market perception of it. A famous example occurred in November 2021, after the launch of the first Bitcoin exchange-traded fund. This event caused Bitcoin to reach its all-time high of $65,000.

However, not all policies lead to positive outcomes. When countries attempt to ban or heavily regulate cryptocurrencies, the market often reacts negatively. Political instability can also drive investors toward bitcoin as a safe-haven asset, causing fluctuations in its value. These examples highlight how closely the cryptocurrency market is tied to government decisions.

Emerging markets, where inflation and currency devaluation are common, have embraced Bitcoin as a financial safeguard. This trend reinforces its position as a viable alternative to traditional assets during economic uncertainty.

In other words, if you’re asking yourself, “Why is crypto going up,” it is because an increasing number of people have a positive market perception of it. A famous example occurred in November 2021, after the launch of the first Bitcoin exchange-traded fund. This event caused Bitcoin to reach its all-time high of $65,000.

Value of all cryptocurrencies

Cryptocurrency prices are affected by a variety of factors, including market supply and demand, news, and government regulations. For example, news about developments in a cryptocurrency’s underlying technology can affect its price, as can news about government regulations. Also, the supply and demand of a particular cryptocurrency can affect its price. Finally, market sentiment and investor confidence in a particular cryptocurrency can also play a role in its price. We cover sentiment and technical analysis for example you can check top coins : Bitcoin, Ethereum, XRP, Cardano, Dogecoin.

Want to know more about any cryptocurrency? Just click on it for a short description and more information! We help you compare and buy cryptocurrency. The prices of cryptocurrencies move up and down all the time. We recommend keeping track of all prices by comparing their charts. The price graph on the right shows the price development during the last 7 days (swipe to the right if you’re on the mobile). This gives you much more information to analyze and trends on the price. Compare cryptocurrencies below →

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

Обзор возможностей интернет гэмблинг-платформы с бонусами

Обзор возможностей интернет гэмблинг-платформы с бонусами

Казино и ставочные компании все чаще советуют применить своими сервисами через интернет. Играть в сети проще и безопаснее. Официальные платформы обеспечивают интерфейсы, адаптированные к технологические параметры разнообразных устройств. К, лицензированное casino 7к казино доступно для игры с ПК и мобильных устройств. Пользователям гемблингового процесса ставок гарантирована безопасность денежных операций и конфиденциальность персональной информации.

Главный веб-сайт казино 7К: как оформить профиль

Открыть персональный профиль в 7K Casino в состоянии всякий совершеннолетний гость. Достижение установленного возраста – требуемая процесс, так как игра на настоящие деньги в интернете возможна с 18 лет. Эту норму придерживаются все лицензионные iGaming-платформы.

Годы игрока верифицируется при проверки аккаунта. Игроку нужно предъявить копии удостоверения личности или альтернативных документов, подтверждающих личность. Проверка пользователя занимает пару часиков. В результате успешной верификации игрок виртуального казино 7K Casino получает соответствующее извещение.

Верификационная процедура доступна тотчас после регистрации. Чтобы оформить регистрацию на главном веб-сайте игровые автоматы 7К, необходимо:

- Перейти на главную веб-страницу виртуального казино.

- Кликнуть иконку «Регистрация».

- Выбрать путь.

- Оформить входную заявку.

- Согласиться с регламентом клуба.

- Завершить процесс.

Игрокам онлайн игорного заведения казино 7К с подарками предоставляется 3 метода учетной записи. Зарегаться возможно по стандартной схеме: с подключением к e-mail или по номеру телефона. Третий вариант – перемещение аккаунтных сведений с аккаунта социальной платформы.

В моменте оформления учетной формы нужно вводить сведения, которые подходят к определенному идентификационному номеру. В случае, когда геймер заводит учетную запись через e-mail, необходимо ввести актуальный e-mail. На этом стадии ещё нужно выбрать тип валюты учетной записи и принять правилами игорного заведения. Прежде чем согласием одобрения с клиентским контрактом советуется просмотреть наиболее важные подпункты.

Окончание регистрационной процедуры – активирование учетной записи. Пользователю нужно перейти по веб-адресу, высланному на e-mail. Когда игрок регистрируется через мобильного номера, ему отправляется текстовое сообщение с кодом. Тайную последовательность необходимо ввести в окно для включения аккаунта.

Новичкам следует учитывать, что любой клиент азартного ресурса вправе создать только единственную аккаунт. По регламентам азартного веб-проекта повторные учетные записи регистрировать нельзя. Аккаунты этого пользователя окажутся запрещены до прояснения обстоятельств инцидента.

Вход в персональный аккаунт онлайн казино

Войти в учетную запись игровые автоматы 7К доступно, если предварительно завершена регистрационная процедура. Логин выполняется по логину и секретному коду. Персональные данные следует вписывать в соответствующие поля. В этом опознавательные знаки должны оставаться прописаны корректно. После того как введения логина и секретного кода необходимо щелкнуть иконку «Войти».

Доступ в индивидуальный аккаунт разрешен только обладателю профиля. Дабы предотвратить приходов чужими особами, регламентом игорного заведения недопустимо сообщать персональные данные. Когда пароль утерян, необходимо сразу же обратиться к представителями службы поддержки клуба. Дежурные агенты саппорта незамедлительно помогут сменить данный ид.

Порой игрок теряет ключ. В подобной обстановке нужно также контактировать в саппорт. Код доступа от личного кабинета будет сброшен на почтовый ящик игрока. Перед восстановления авторизации к аккаунту представитель службы поддержки верифицирует клиента гемблинг-сайта казино 7К. Аутентификация выполняется путем направления рабочей URL, переход по этой ссылке перенаправляет на страницу восстановления пароля. Воспользоваться указанным ссылкой можно, если есть подключение к почтовому ящику.

Восстановить ключ можно не прибегая к контактов в техническую поддержку интернет-клуба. Подходящая функция имеется на официальном веб-сайте лицензионного казино. Гостю следует кликнуть кнопку «Забыли код доступа». После этого нужно руководствоваться пошаговым рекомендациям. Подключение будет восстановлен по результатам проверки личности обладателя аккаунта.

Авторизация внутрь профиль сертифицированного онлайн-казино доступен посредством аккаунт в соцсети. Гостям азартного заведения 7K Casino рекомендуется применить одной из самых популярных сервисов: Odnoklassniki, Фейсбук, Телеграм, ТикТок и прочие. С целью авторизоваться этим путем, нужно залогиниться через социальную сеть и согласиться на обработку личных данных. После выполнения совершения этих шагов логин в online casino выполняется самостоятельно.

Внесение счета и выплаты добычи

Денежные операции доступны исключительно авторизованным участникам. Финансовые транзакции проводятся через современные системы оплаты. К примеру, кредитные карты, интернет-банкинг или криптовалютные кошельки. Значимость этого или другого подхода выявляется в зависимости от области жительства игрока. Для того чтобы выбрать идеальную методику платежей, можно связаться с отделом помощи клиентам игорного заведения.

В процессе определения платежного услуги следует принимать во внимание несколько аспектов. Следует брать в учет следующие аспекты:

- ограничения на пополнение/вывод средств;

- существование комиссий

- время финансовых перечислений;

- доступность финансовой сети

- защита транзакций.

Игрок-новичок может приступить играть в автоматы на бабки после депозита минимального депозита. Нижний предел депозита задается для любого финансового сервиса оплаты. Пределы всевозможных денежных механизмов могут разниться. Таким образом до внесением начального вложения не не лишним будет выяснить объем минимум суммы.

Ограничения также распространяются при снятии финансов. Объем к выплате должна соответствовать определенному ограничению. Вывод выигрышей выполняется согласно правилам казино игровые автоматы 7К. Детальные условия осуществления финансовых сделок описаны в соответствующих секциях публичной оферты.

Для того чтобы снять деньги, нужно зайти в раздел «Касса». После этого необходимо нажать клавишу «Выплата». Открывая на мониторе выводится каталог актуальных систем оплаты. Пользователю нужно подобрать соответствующий выбор. Например, финансовую карту Visa. В форме на снятие следует указать:

- реквизиты банковской карты

- размер к выплате;

- номер аппарата

- секретный шифр из СМС.

Ввод SMS – утверждение транзакции. Требование на выплату отправляется в рассмотрение. Продолжительность рассмотрения требования обусловлена множеством причин. На протяжении время рассмотрения анкеты влияет занятость операторов на смене. Характеристики и аспекты оплатного обслуживания тоже имеют значение. Обычные периоды поступления средств составляют 20-40 минут с времени оформления запроса.

Вывод выигранных денег разрешен, в случае, если призовой баланс освоен. Об данном правиле вознаграждений не следует забывать. Предоставленные фонд необходимо отработать или можно не принимать премии. Промо финансы располагаются на бонусном балансе. Его баланс отображается внутри персональном профиле участника.

Во время получения средств важно учитывать потенциальные сборы. Малые комиссии удерживаются процессинговыми компаниями, осуществляющими финансовыми операциями. Данные сборы определяются финансовыми учреждениями. Немедленно казино казино 7К отдает целую ставку. Более детализированная подробная информация, связанная с комиссий и прочих условий платежей, выкладывается на веб-сайте компании финансового учреждения.

Защита денежных операций – дополнительный критерий достоверности операций по депозиту/снятию денег. Официальный игорный дом задействует особое программное обеспечение. К системы защиты, актуальные методы кодирования, межсетевые экраны и различный ПО.

Программирующее обеспечение гемблингового ресурса функционирует вкупе с инструментами финансового обслуживания. Известные денежные фирмы оберегают своей репутации. По этой почему платежные сервисы защищаются специальным шифровкой. Соединение HTTPS представляет собой самым безопасным для пользователя казино и интернет-казино. Это содействует продуктивно защитить монетарную информацию (информацию бумаг и кредиток).

Премии на формальном веб-ресурсе гемблингового заведения

Популярность азартного сайта определяется числом доступных бонусов. Чем богаче набор призовых акций, тем больше поток геймеров. Сертифицированное игорное заведение 7K Casino постоянно предоставляет следующие промоакции:

- Welcome reward.

- Прогрессивный джекпот.

- Соревнования с значительными наградами.

- Финансовые тиражи.

- Крутки Колеса Удачи.

- Возврат средств (частичное компенсация расходов).

Введение с премиальной системой гемблингового онлайн-платформы начинается с приветственного вознаграждения. Приветственный бонус включен в обойму промоакций большинства топовых виртуальных заведений. Поскольку конкуренция между гемблинг порталами непрерывно увеличивается, гемблинг площадки предлагают для игроков все более привлекательные оферы.

Начальный bonus казино 7К разработан для запуска гейминга на настоящие средства на наиболее дружественных положениях. С целью чтобы новичок прошел регистрацию, online casino согласенo подарить фиксированную сумму. Однако, денежный трофей предоставляется не в виде бездепозитного бонуса. Бонус предоставляется, в случае, если первый клиент внес вклад.

Начальный пакет доступно запустить тотчас по окончании регистрации. В его набор могут входить монетарные начисления и бесплатные вращения. Размер вступительного вознаграждения обозначается в регламентах промо предложения. Например, 100% + 30 фриспинов.

Участвовать в интернет казино с премиями лучше, нежели на портале без экстра призов. Бонусные фонды допустимо конвертировать в реальные суммы. После трансфера вознаграждений на центральный счет их без проблем обналичивают. Акционные деньги могут быть получены к выплате, если пользователь выполнил требования вейджера.

Вейджеры указываются для каждых пополняемых начислений. К примеру, десятикратный или х35. Чем значительнее коэффициент, настолько сложнее правила отыгрыша бонусных денег. Если вейджер x10, бонусные средства необходимо прокрутить в десятикратном размере.

Кроме вкладных премий, на официальном портале 7K Casino имеется ряд прочих доходных предложений. Регулярные вращения слотов могут закончиться выигрышем джекпота. Джекпот – совокупный призовой пул, который накапливается со всех оплаченных взносов авторизованных пользователей. В копилку денежного приза поступает микро депозит с каждой пари. В результате на ставке может быть свыше 1 000 000 рублей.

Участники игры соревнования за кушом ничего не теряют. Азартному игроку придётся продолжать крутить в слоты на деньги. При данном возможности сорвать главный джекпот существуют в том числе у тех игроков казино, которые ставят маленькие ставки. Владелец выигрыша игровые автоматы 7К выбирается с помощью софта ГСЧ (случайный генератор). При данном обещается добросовестность и беспристрастность со позиции работников интернет-клуба.

Примерно по этому же методу выбираются победители лотерей. Азартные билеты допустимо закупить на реальные средства. К каждой всякой лотерейной игре определяется стоимость индивидуального тикета. Розыгрышные купоны также могут быть выданы в качестве вознаграждения за регулярные депозиты на баланс.

Каждый игрок гэмблинг-клуба имеет право иметь неограниченное количество розыгрышей. Чем большее число купонов приобретено, тем значительнее вероятность захватить джекпот. Алгоритм ГСЧ назначает победителей случайно без влияния со стороны руководства казино.

Сертифицированный клуб игровые автоматы 7К вознаграждает каждого зарегистрированных пользователей. Для каждого всякого игрока ведется запись их деятельности. Чем больше посетитель крутит в аппараты на реальные средства, тем значительнее бонусов и акций ему открыто. Среди пользователей больше всего любимы следующие промо – welcome bonus, чемпионаты и джекпоты.

Авторизация в онлайн игорное заведение с смартфона

Создатели игровых сайтов намереваются максимально улучшить их доступ. С целью игроки могли без задержек приступить к азарту на деньги, рекомендуется применять подстраивающиеся сайты online casino. Предлагается двойка выбора: портативная редакция утвержденного интернет-ресурса и сертифицированное приложение с однорукими бандитами.

Провайдеры гемблинговых сайтов принимают во внимание предпочтения всевозможных типов игроков. Некоторые игроки выбирают запускать игры со мобильных устройств Android. Для них подготовлена онлайн модификация плюс смартфонное приложение игорного заведения. Кроме того имеются игроки, которые выбирают девайсам iPhone и iPad. Им предложены соответствующие кроссплатформенные программы: мобильная версия и приложение для iOS.

Сыграть удобно как посредством браузер портативного гаджета, так и в загружаемой софтвере. Особенности обеих систем приблизительно одинаков. Отличие лишь в, что именно в приложении существует вмонтированное mirror. С помощью данного средства программа автоматически обходит блокировки. Актуальное альтернативный сайт пригодится для игроков, на местности нахождения которых онлайн-гейминг запрещен.

Скачать приложение гэмблинг-платформы можно абсолютно даром. Приложение предоставляется в бесплатно как для iPhone, так и Android-устройств. Формат инсталляционного пакета для систем Андроид – APK. Тип инсталляционного пакета для девайсов серии Apple – IPA.

Мобильная модификация геймерского салона не запрашивает скачивания и монтажа. Данное основное преимущество веб-ориентированной площадки. Портативная онлайн-версия загружается автоматически при входе на основной сайт с какого угодно переносного девайса. На такой подойдет какой-либо даровой веб-обозреватель. Азартные игроки обычно задействуют следующие web-просмотрщики: Opera, Google Chrome и Mozilla Firefox.

Любые неполадки с уровнем материала не имеются. Большинство лицензионных аппаратов спроектировано на движке HTML5. Сравнительно с софтом Flash такая техника обладает несколько плюсов. Плюсы выражаются в обеспечении высокого уровня игровых услуг.

HTML5 – это универсальный кодовый код для организации и отображения контента во интернете. Универсальность ПО заключается в комфортной опции оперативно стартовать HTML5-геймы на любых системах. При этом предоставляется не только молниеносная подгрузка игровых автоматов, но и удобный подход к другим услугам игорных порталов: премии, промо-коды, депозиты, получение выигрыша.

Пользователь смартфона может сам определить идеальный способ входа. Сыграть в слоты комфортно как посредством веб-обозреватель, так и в программе. Приложение нужно загрузить и интегрировать на личное гаджет. На скачивание и монтаж программы нужно затратить не более 2-3 минут. Поэтому никаких затруднений со скачиванием не возникает даже у новичков в игре.

Все платформы официального виртуального казино нацелены на обеспечение приятных и безопасных условий игры. Для того чтобы обрести право доступа к платным функциям гемблингового портала, необходимо осуществить несложную процедуру регистрации. Новым игрокам также необходимо сделать начальный депозит. Вносить счет легко и надежно с всякого аппарата (ПК, лэптоп, телефон или планшет).